michigan unemployment income tax refund

Account Services or Guest Services. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year.

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

259 on up to 54615 of taxable.

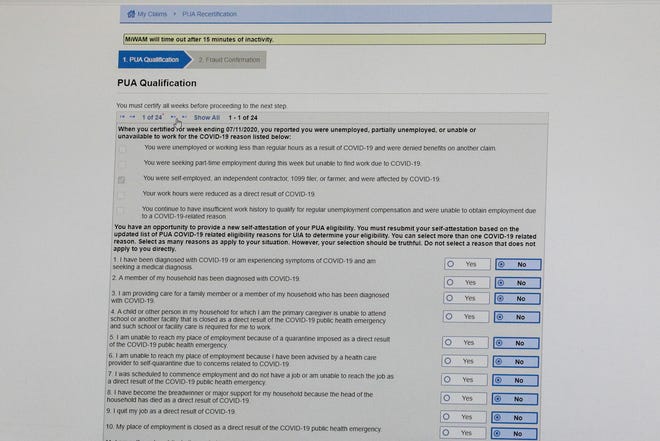

. President Bidens recent federal American Rescue Plan Act excludes unemployment. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes. For the federal income tax return total unemployment compensation is reported on Line 7 of federal Form 1040 Schedule 1.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. If you are unable to access a quiz or did not pass please send in the documents requested from your letter.

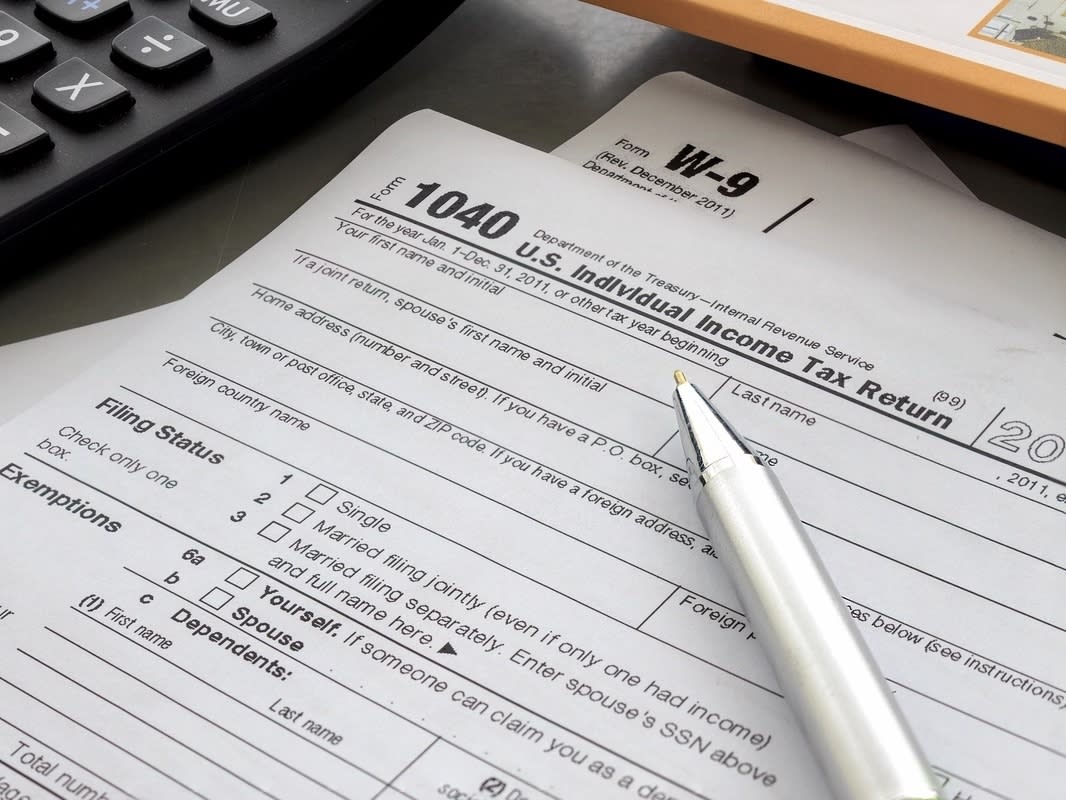

Garnishment of State Tax Refund by Other Creditors. These taxpayers should file an amended Michigan income tax return to claim that refund. Say Thanks by clicking the thumb icon in a post.

If a creditor has a judgment against you and wants to garnish your tax refund it must file a Request and Writ for Garnishment with the court. Tax season started Jan. Include all forms and schedules previously filed with your original return.

State Income Tax Range. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release.

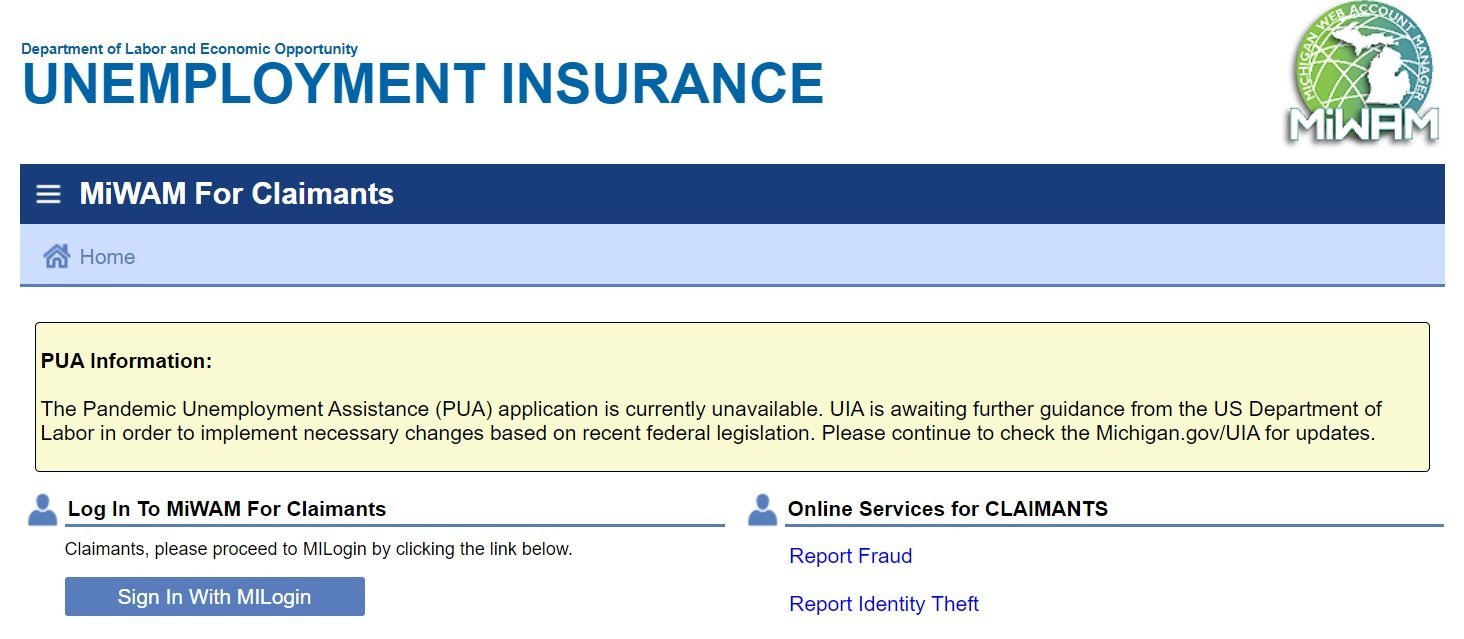

By accessing and using this computer system you are consenting to system monitoring for law enforcement and other purposesUnauthorized use of or access to this computer system may subject you to state and federal criminal prosecution and penalties as well as civil penalties. You received a letter from the Michigan Department of Treasury directing you to this web site to confirm your identity or identify the return as suspicious. During the pandemic federal law was changed so.

Then the creditor must file the writ with the Department of Treasury. Include schedule AMD which captures the reason why you are amending the return. Michigan residents who paid taxes on unemployment benefits in 2020 must file an amended tax return with the state in order to get that money back.

However you dont pay tax in Michigan on unemployment if you no longer live in Michigan. Michigans state income tax is 425. Use the MI-1040 and check the amended box.

If Michigan tax was withheld you would have to file a Michigan return to get a refund of the Michigan withholdings. The creditor must also serve a copy of the writ on you. The State of Michigan has issued a decision on the treatment of unemployment compensation for the 2020 tax year.

If you use Account Services select My Return Status once you have logged in. Michigan has a flat income tax rate of 425. The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts such as delinquent taxes state agency debts garnishments probate or child support orders overpayment of unemployment benefits and IRS levies on individual income tax refunds.

If Your Refund is HeldOffset to Pay a Debt. To check the status of your refund use. That means the average refund for one week of unemployment from last spring and summer would be roughly 40.

Michigan officials arent sure how many Michiganders are owed state unemployment tax refunds Leix said. The net taxable unemployment compensation from federal Form 1040 Schedule 1 is included in. Additional Income and Adjustments to Income.

To complete properly check Box N and on line 8 Explanation of changes please write Federal Unemployment Exclusion. His clients are basically averaging around 430 in extra state refund money after being able to reduce their taxable income by 10200. When you create a MILogin account you are only required to answer the verification questions one time for each tax year.

I filed a tax return I had a tax return filed on my behalf. The federal unemployment exclusion is reported on line 8 of the federal Form 1040 Schedule 1. Federal tax rates are much higher between 10.

Theres a flat 425 tax on most income in Michigan. There are two options to access your account information. The latter will vary between households depending on overall income your tax bracket and how much of your earnings came from the benefits.

Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020. Please allow 6 weeks to process your refund if you passed the quiz. You pay tax in your home state only.

But even as workers await the document the state has yet to decide whether thousands of jobless workers will have to repay up. Arizona taxes unemployment compensation to the same extent that its taxed under federal law. 24 and runs through April 18.

June 1 2019 236 PM No. Before starting this process please select the appropriate option below. I filed my Michigan Individual Income Tax Return MI-1040 before the passage of the federal legislation that excluded up to 10200 per qualified individual based on income limits in unemployment income.

This system contains US. State Taxes on Unemployment Benefits. Federal tax rates are higher meaning.

I wish to take the Michigan Identity Confirmation. Allow up to 12 weeks for your refund to be processed. In the latest batch of refunds announced in November however the average was 1189.

You may check the status of your refund using self-service. Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment. The federal tax code counts jobless benefits.

Waivers For Pandemic Unemployment Overpayments Could Come This Weekend

Unemployment Benefits Are Taxable Income That May Reduce Eitc Refunds Next Spring

Inside Michigan S Faulty Unemployment System That Hit Thousands With Fraud Michigan The Guardian

Form Mi 1040 2011 Michigan Individual Income Tax Return

Michigan Workers Are Being Asked To Repay Thousands In Uia Benefits Received During The Pandemic

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Income Tax Season 2022 What To Know Before Filing In Michigan

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Whitmer Pushes Back State Tax Filing Deadline Crain S Detroit Business

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

Where S My Refund Michigan H R Block

State Pushes Back Release Of Unemployment Aid Tax Forms

State Of Michigan Taxes H R Block

Michigan Uia Pauses Collections On Benefit Overpayments Amid Case Reviews

Michigan S Delayed 1099 G Unemployment Tax Forms Now Available Online Mlive Com

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com